More and more destinations around the world are introducing tourist taxes and there is a large number of European countries and cities that have started implementing it. It usually consists of a fee that applies per person per night. The tourist tax is payable locally, and usually at check out from your accommodation.

The European Tourist tax, also called ‘city tax’, usually consists of a fee that applies per person, per night. The tourist tax is payable locally, and usually at check out from your accommodation. Many governments are concerned with the possibility of over-tourism in a destination, therefore they decided to implement a tourist tax to improve the tourism sector. The taxes are considered as resources to protect the environment, cultural heritage, or social purposes of a destination.

The rates vary from the type of accommodation and its location. The higher the rating of the accommodation you chose is, the more you will have to pay. Eastern EU countries have lower rates than Western and South-eastern EU countries. However, the amount of the tourist tax is decided by the city or the municipality and can change annually. You will find the tourist taxes’ rates of the country you are planning to visit below.

Everyone has to pay tourist taxes, however, there are some exemptions depending on the city:

Children often pay reduced rates or are exempt entirely

Persons with a disability and one accompanying person

Patients and carers for patients admitted to health facilities

Workers within the city

Bus drivers

Tour Guides

To be exempt from paying tourist taxes, you have to prove your situation with the appropriate documents.

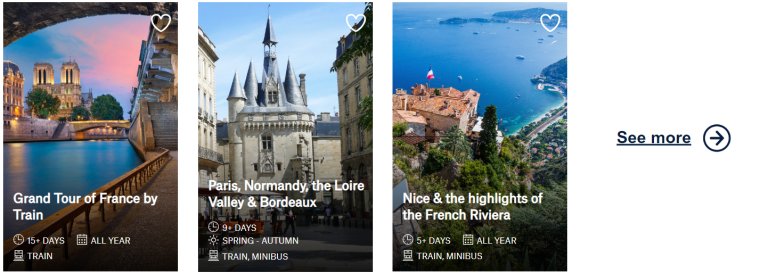

In France, there is a tourist tax or "Taxe de Séjour", which is charged per person, per night and varies according to the standard and quality of the accommodation.

The rates range from EUR 0.65 to EUR 8,13 per person, per night. The detailed price breakdown is available (in French only) on the service-public.fr website. To calculate the actual tourist tax amounts due, multiply the rate applicable to each category of accommodation by the number of nights and the number of taxable persons. Children under 18 are exempt from the tax.

Note: An additional tax can also be added by the counties and regions. For example, the Île-de-France region recently introduced an additional “Grand Paris” tax. From 1 January 2024, the tourist tax in Paris will be EUR 5,20 per person per night when staying at a 3-star hotel, and EUR 8,45 per night per person when staying at a 4-star hotel.

When booking a self guided trip to France, tourist taxes are usually not included and must be paid locally. If you travel in a guided small group, tour operators tend to include the taxes in the package price.

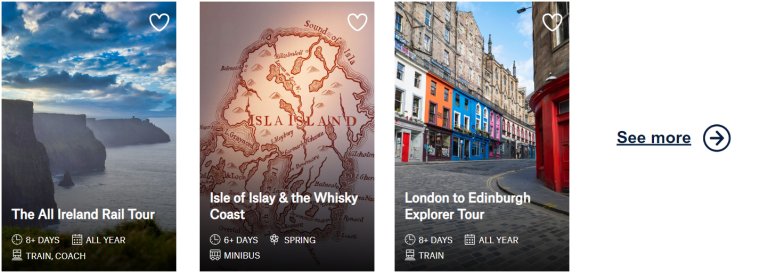

England: Manchester is the first and only British city to charge a £1 tourist tax to visitors staying in the city-centre hotels or rental apartments. Other UK’s leading destinations could impose tourist taxes in the coming years.

Ireland: There are currently no tourist taxes in Ireland.

Scotland: There are currently no tourist taxes in Scotland, but there are undergoing discussions. Edinburgh is set to become the first city in Scotland in 2023 to introduce a £2 tourist tax per person and per night.

Wales: There are currently no tourist taxes in Wales, but there are undergoing discussions.

When booking a self guided trip to the Uk & Ireland, tourist taxes are usually not included and must be paid locally. If you travel in a guided small group, tour operators tend to include the taxes in the package price.

In the Netherlands, there is a tourist tax of EUR 3.- per person per night payable locally. Some hotels have included it in their rates and some have not. You will be informed at the time of reservation if it is payable at the hotel upon check out.

In Italy, the amount of the tourist tax depends on the city. In Rome, you will be charged between EUR 3 - 7 per person, per night. In other cities, the rates vary from EUR 2.- to EUR 5.-

In Switzerland you will be paying tourist taxes, the amount varies in different cantons and towns & cities. The cost per night and per person is around EUR 2.20.

In Slovenia the tourist tax is €1.50 to €3 per person per night, often to be paid directly at the hotel reception.

In general between €1 and €2.50 per person per night, to be paid directly at the hotel reception.

In general between €1 and €4 per person per night, to be paid directly at the hotel reception.